- Tactical Tips by DECODE

- Posts

- 🚀 How to plan your runway

🚀 How to plan your runway

3 tactics, 2 traps and 1 tool to plan runway

Hello founders!

Welcome to ‘Tactical Tips’ by Jerel and Shuo at DECODE, where we cover one new idea to help you build and grow your startup – every week in <5 minutes!

Today, we’ll be answering the question: “How to plan your runway?”

And here’s advice inspired by Sequoia and Josh Kopelman, Founding Partner at First Round Capital.

If you want to build a plan that protects you in the worst-case recovery but positions you to win in the best-case, today’s newsletter is for you.

🔥 Inside this issue:

✅ 3 tactics to plan your runway

✅ 2 traps to avoid

✅ 1 tool to leverage

👇Let’s dive in.

Grab 30 mins with Jerel - Need personalized advice on building your startup or just want to talk? Happy to help and make intros if it’s the right fit.

💌Someone shared this with you? Subscribe here.

Meet with execs from OpenAI, Lightspeed, Roblox, Spotify, Higgsfield and more (200 spots only)

💬 Have intimate roundtable discussions with speakers including:

Kevin Weil | Chief Product Officer, OpenAI

Tony Jebara | VP of Engineering, Head of AI/ML, Spotify

Arvind KC | Chief People & Systems Officer, Roblox

Alex Mashrabov | Founder & CEO, Higgsfield AI

🍽️ Join an invite-only dinner with advisors including:

Keith Enright | Former Chief Privacy Officer, Google

Mark Settle | 7X CIO (including Okta)

Esther Wojcicki | ‘Godmother of Silicon Valley’

Mike Grandinetti | Faculty at Brown, Harvard and Rutgers; CXO with 7 exits

💻 Demo your product to investors including:

Barry Eggers | Founding Partner, Lightspeed Venture Partners

David Jen | MD of Finance at X, Alphabet's Moonshot Factory

Joy Chen | Senior Advisor, GSV Ventures

Nicole Baer | Chief Marketing Officer, Carta; Limited Partner, GTMfund

Use promo code: DECODE for a 30% discount

“Reply” to this newsletter if cost is a barrier. We provide scholarships to those who are serious about their entrepreneurship journey.

3 tactics to plan your runway

🔎 Identify key uncertainties

Focus on 6-10 uncertainties with the biggest business impact for you; everyone’s list will be different

Cover both macroeconomic and assumptions you want to test around the market, customers, and other stakeholders

Example for a ridesharing platform in a high interest rate environment:

Will higher borrowing costs reduce consumers’ discretionary spending on ride-hailing versus cheaper alternatives like public transit?

Will drivers face tighter access to auto loans or higher financing costs, reducing supply on the platform?

Will corporate travel budgets shrink as companies cut costs, lowering premium rides demand?

Will higher rates erode driver and platform margins due to rising costs?

Will a tougher fundraising environment constrain expansion into adjacent bets (e.g. delivery, freight, autonomy)?

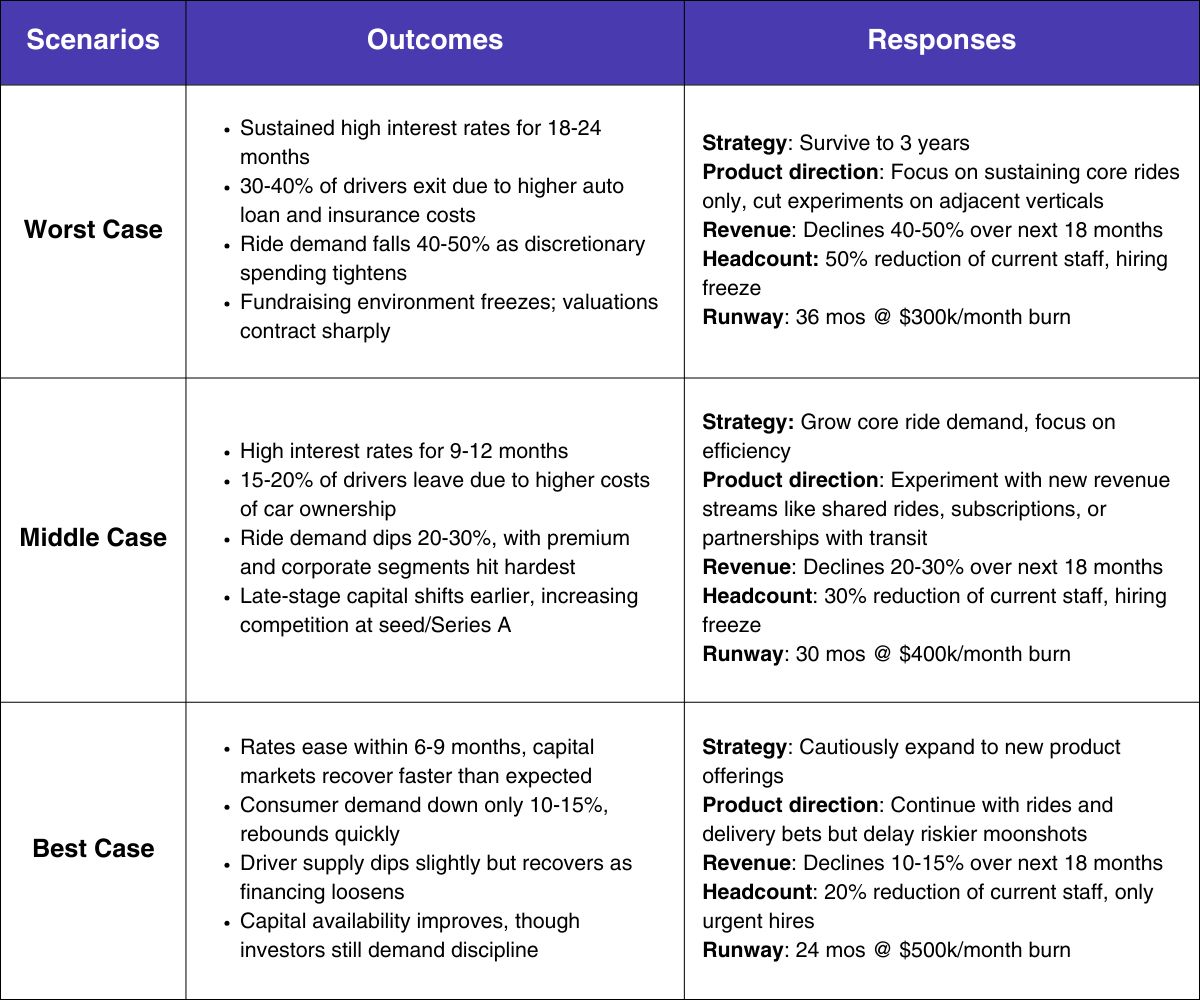

🪣 Bucket into scenarios and craft responses

Create 3 or more scenarios(eg. worst case, middle case, best case) using combinations of outcomes from the list of uncertainties created

Ensure each scenario includes a plausible combination of outcomes and captures a useful business case

Outline how business strategy will change scenario-by-scenario:

Break down steps you will take in terms of product direction, revenue targets and headcount

Calculate the runway and burn rate you will see as a result

Continued example for the ridesharing platform:

⏰ Set trigger points to signal scenarios

Identify macro and internal signals that tell when each scenarios is happening

Monitor signals -> determine the relevant scenario -> execute the corresponding responses

Archive old uncertainties, scenarios and responses every 2-4 weeks

Assess what's changed, whether scenarios are still realistic, whether to alter course of action, and rewrite new ones

Continued example for the ridesharing platform:

2 traps to avoid

🚨 Extending runway by cutting costs without a plan

Undoing cuts and restarting product development or go-to-market might take longer than the additional runway from cutting costs

Budget cuts should lead to a clear path forward and should be more than just ‘X more months of burn’

🚨 Mistaking scenarios and increasing burn because revenue increased

Revenue from the wrong customers = false traction and signal that lead you to the wrong scenario

Be skeptical and check if customers use the product for the same core reason

If usage isn’t aligned, pause spending; burning cash won’t fix the misalignment

1 tool to leverage

📖 Best practice on planning runway

Typical pre-product-market-fit team size tends to be 5-9 full-time employees with the bulk being engineers

Leverage this simple matrix from Sequoia to plan your scenarios

Bonus: 1 trend to spark startup ideas

📈 Manual fraud defense systems are costing financial institutions millions

Financial crime compliance costs surged to $274B globally, and financial institutions are losing $98.5M annually to fraud, cyber threats, and operational inefficiencies

Every dollar lost to fraud now costs $5 in total impact (up 25% from $4 just four years ago)

Manual reviews create bottlenecks that delay legitimate transactions, sour customer experiences, and leave critical alerts unresolved

Opportunities to transform financial security:

Real-time fraud detection: Machine learning algorithms that analyze transaction patterns instantly, cutting false positives to manageable levels while catching sophisticated attacks that slip past rule-based systems

Automated compliance orchestration: AI-driven AML and KYC processes that eliminate manual reviews for cases, reducing compliance costs while improving detection accuracy through multi-layered analysis

Behavioral biometrics: Continuous authentication that tracks user patterns in real-time, stopping account takeovers before damage occurs while maintaining seamless customer experiences

Continue learning

Other resources

Apply to participate in Founders Pop-up Board Advisory and receive startup feedback from execs at Microsoft, Google, Meta, Reddit (Free)

Schedule for a consultation on structuring your equity-based compensation plan (Free).

Fill this form and we’ll get in touch for details on how we can get your brand in front of our community.

Still figuring out your startup idea?Take our free course ― Zero to Startup: How to Identify a Winning Idea Fast, where you’ll receive 1 email per day over 5 days to help you get started! |

What did you think of today's content?Your feedback helps us improve. |

Please complete this 2-min survey to help us get to know you and better tailor content for you.

“Reply” with any follow-up questions you might have, and we’ll work on covering them in a future newsletter!

Stay tuned for more startup wisdom in next week’s edition!